2014 Financial Year in Review

I did an analysis of my transaction history for 2014 to try to dig up answers to a question that has been in the back of my mind all year: How am I spending my money?

In the spirit of radical transparency, here are the numbers.

Dataset: Transactions

- Paychecks: $75225

- Savings: $39713

- Savings Rate: 52.8%

- Rent: $9600/yr

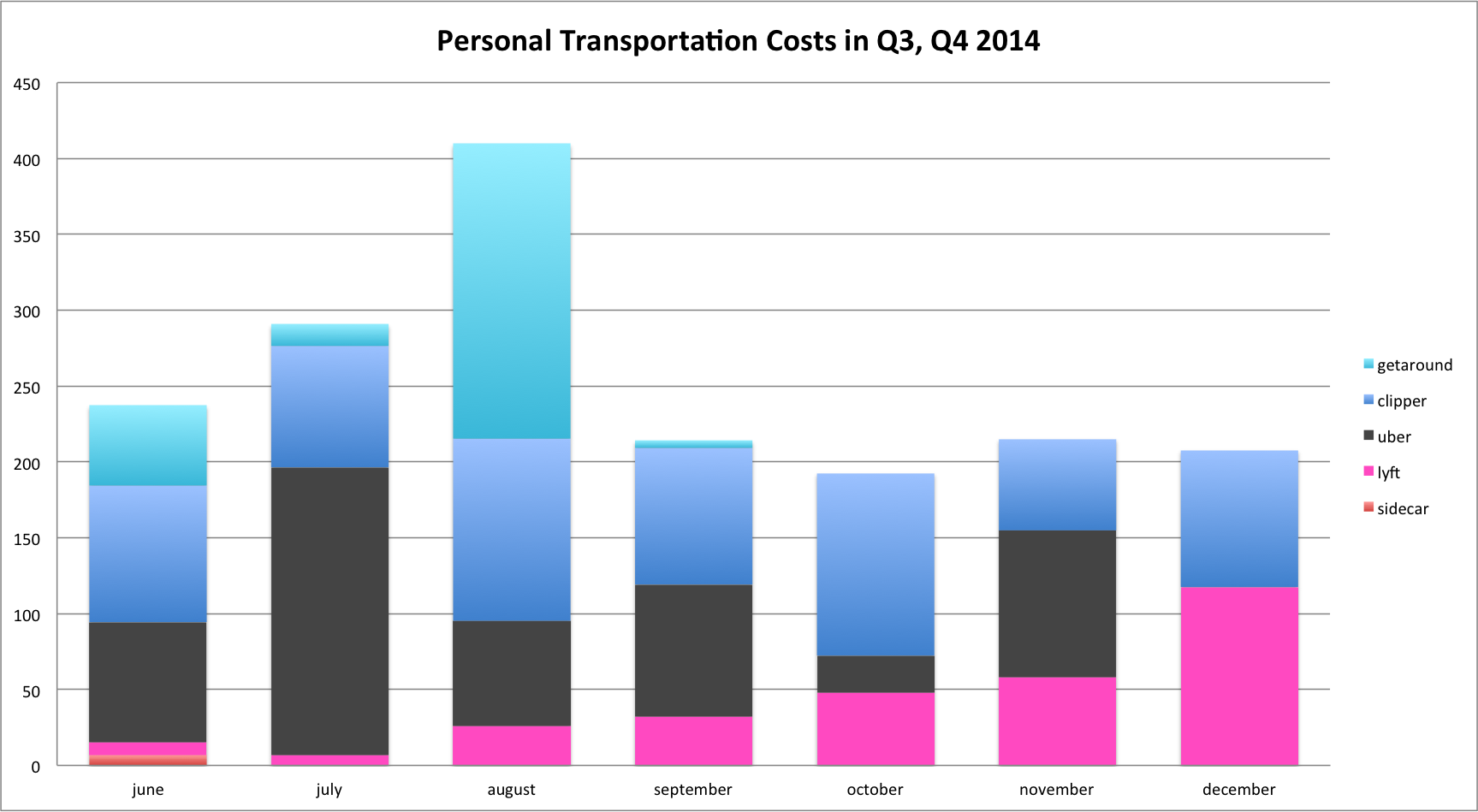

- Average Rideshare Spend: $121/mo

- Average Total Transportation Spend: $252/mo

- Big costs of 2014:

- Equity: $7096.61

- Personal Debts: $2300

- Trip to Chicago: $635 + $608 flight for 2 = $1243

- Trip to Denver: $595 trip + $262 flight = $857

- Trip to KC: $514 trip + $345 flight = $857

- Total 2014 Subway Spend: $172

- Average Subway Meal: $6.10

- Total 2014 Lee’s Deli Spend: $389

- Average Lee’s Meal: $8.84

- Approx. Calculated Food/Discretionary: $876/mo -> $29.2/day

Graphs

Conclusions and Goals

After taking income and subtracting savings, travel, transportation, and unexpected large costs, the remainder comes out to about $876/mo, which is $29.2 a day in food and discretionary spending. If I were to reduce this by 30% and save it, this would come to around three thousand dollars, which would increase my savings rate by only 4%, and given that a 30% cut in discretionary income would involve changes in my lifestyle, I would say that I did a good job this year of managing my money appropriately. What this analysis says is essentially that my food and discretionary (not including travel) spend comes to use 13% of my annual income, which I am comfortable with.

Total travel spend this year comes down to approximately $3.5k, which is about 5% of my income, which I see as too little. In 2015 I want to travel more, and aim to increase that percentage to 7% which would correspond with a large trip every quarter.

As for savings goals, my goal is to continue to avoid lifestyle inflation and exceed a savings rate of 55% for the next year. If no large unexpected big costs occur, then both my travel and savings goals should be attainable. If some unexpected costs come up as they always do, I will probably cut into my savings rate rather than travel just because I may only have the next decade to travel with true freedom. Another goal for this year is to find a way to put more time into volunteering and philanthropy as I know many people don’t have the opportunity to pursue financial independence.