2018 Financial Year in Review

3 years ago I wrote a 2014 Financial Year in Review that documented my spending habits. Since then, my life has changed a lot. I live in a nice 1 bedroom in the edges of SF instead of in a converted closet-room in the Tenderloin. I travel more to see family and friends. And I spend more freely now (more weekend trips, entertainment, and hobbies).

This year has also been a year of change for me. I’ve had a windfall from the acquisition of TINT (which I’m excluding from this analysis). Lots more stuff going on in my life, and I’m frequently feeling like I’m spending too much. How does it actually stack up?

Data set: Transactions

- Paychecks: $39,207

- Total spend: $55,850

- Savings: -$16,643

- Rent: $18,000/yr

- Average Rideshare Spend: $154/mo

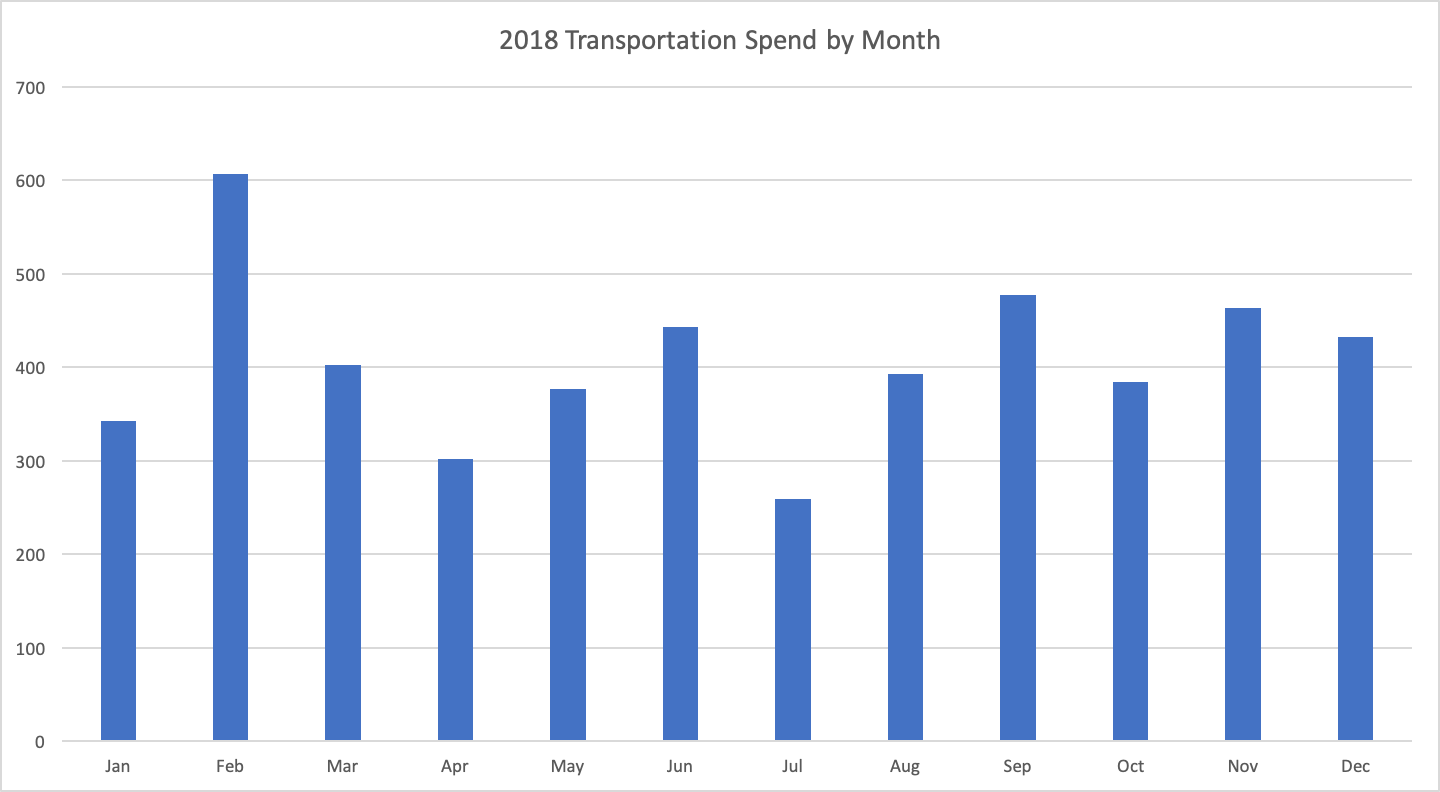

- Average Total Transportation Spend: $406/mo

- Travel: $11,771

- Restaurants: $5,876

- Groceries: $1,849

- Big ticket items:

- Flight to Japan - $1,152

- Flight to Italy - $1,049

- Amazon: $1,049

Charts

Reflections

Since 2014, my paychecks haven’t changed much, but my spending has. My lifestyle inflated alongside the outcome from the acquisition of TINT. My spending increased 57% from back then, from $35k to $55k, a $20k increase. Almost half of that change is from my rent increasing from $800 to $1500. The other $12,000 is mainly from my increase in travel (3.5k → 11.8k) and transportation (3k → 4.9k).

I went on 11 trips requiring a flight this year and did something special almost every month. I don’t regret it, but it came at a cost. 21% of my spend this year was on travel. And for the transportation, a big chunk of it was riding BART from Oakland for my daily commute, as well as an increase in renting cars to go on day trips. My rideshare expenses have also increased slightly, from 1.4k to 1.8k, so I’m roughly taking 4-5 more Uber/Lyft rides every month.

Also, I’ve always wondered, “How much could I save if I ate out less?”. Taking a look at my monthly food spend broken down by groceries vs restaurants, I find that I spend about $150 a month on groceries and $489 a month on restaurants. If I halved my restaurant spend and doubled my grocery spend, I could cut costs by $170 a month. Now I know.

Overall, looking at the numbers has me thinking about my goals during this time of transition. If I am going to start a family in the near future, will we be able to afford staying in the Bay Area, or will it make more sense to move to a place with a lower cost of living?

Also, how long can I give up a regular job and enjoy the flexibility of entrepreneurship without impacting my ability to stay here? What is that worth to me? And if/when I start looking for a job, what will I pursue?

All questions that I don’t have answers to yet, but at least now I know how much it will cost to pursue my new ventures.

Extra Stuff

I didn’t know how to do this quickly in Excel, so I wrote a little script to help me categorize my transactions. Putting it here in case I want to use it again in the future.

| # categorize.py | |

| # Script to categorize transactions based on their name | |

| # Remember to remove commas from the csv since converting bank statements to csv's don't do that for you | |

| # Assumes the columns in the input file are date, name, amount, type | |

| # Fifth column is added by the script and saved as a new file | |

| import csv | |

| input_file = 'all-transactions.csv' | |

| output_file = 'categorized-transactions.csv' | |

| categories = { | |

| 'transportation':['uber', 'lyft', 'clipper', 'getaround', 'zipcar', 'gig', 'limebike'], | |

| 'shopping':['amazon', 'amzn'], | |

| 'new_category':['add', 'the', 'keywords', 'you', 'want', 'to', 'use', 'here'] | |

| } | |

| with open(input_file, newline='') as csvfile: | |

| csv_reader = csv.reader(csvfile, delimiter=',', quotechar='|') | |

| with open(output_file, 'w', newline='') as csvfile: | |

| csv_writer = csv.writer(csvfile) | |

| for row in csv_reader: | |

| found_category = '' | |

| name = row[1] | |

| for category, keywords in categories.items(): | |

| for keyword in keywords: | |

| if keyword in name.lower(): | |

| found_category = category | |

| csv_writer.writerow([row[0], row[1], row[2], row[3], found_category]) |